The Problem With the S&P 500

The S&P 500 Index had a great summer in 2020. Business news reports were full of rallies, record up days, and economic recovery.

The Summer Rally

(S&P 500 Monthly Returns)

April: up 12.7%

May: up 4.5%

June: up 1.8%

July: up 5.5%

August: up 6.6%

But before you use the S&P 500 as an indicator of the health of the economy or even the performance of the equity markets as a whole, it helps to understand what, exactly, the S&P 500 is.

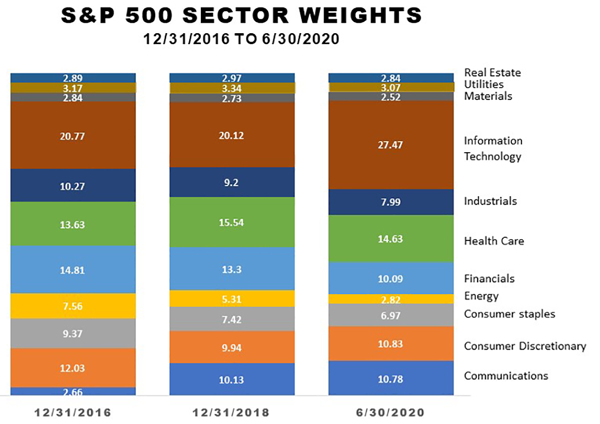

The S&P 500 Index is a weighted measurement of the performance of the 500 largest publicly traded U.S. companies. Although 500 stocks are included in the index, just five stocks (1% of the companies that make up the S&P 500) currently account for more than 25% of the index. Those stocks are Microsoft, Apple, Amazon, Alphabet (Google), and Facebook, all found in the Information Technology sector. Covid-19 has been very good for the sector as Americans turned to technology for entertainment and business applications. With information technology stocks making up 27% of the S&P 500 market capitalization, a good quarter for the sector generally means a good quarter for the S&P 500.

The reason that one sector can essentially drive the performance of the whole index lies in the structure of the index. The S&P 500 index is a market capitalization weighted index. Market cap is calculated by multiplying the number of publicly traded shares outstanding by the market price of one share of the company’s stock. As a result, not all companies’ performance, or value, are reflected equally in the final sum. Each of the five stocks listed above has a greater influence on the S&P 500’s returns than any other stock because of its market capitalization.

At the same time that their market capitalization drove changes in the value of the index, the big five were not the best performing stocks in the S&P 500 index. From the start of lockdowns on March 10th though August 2020, Abiomed Inc., Advanced Micro Devices Inc., Cadence Design Systems Inc., Chipotle Mexican Grill Inc., Halliburton Co., Nvidia Corp., PayPal Holdings Inc., Tractor Supply Co., United Parcel Service Inc. Class B and West Pharmaceutical Services Inc. were at the top of the performance list. Energy and financial companies were among the worst performers.

The concentration of the S&P 500’s value in just five companies offsets the value of diversification in the index and does not reflect the U.S. economy as a whole.

There are drawbacks to being big as well. The sheer size of the big five companies makes it difficult to achieve substantial revenue growth. A 25% increase in revenue for a company with $1.5 million in annual sales is just $375,000. With revenue of $273 billion for the year ending June 30, 2020, Apple would need to increase sales by $68 billion to achieve a 25% growth rate. Its actual sales growth for the period was 5.7%.

The S&P 500 is more vulnerable to market volatility because it is the most popular investment index. While you cannot invest directly in the S&P 500, you can invest in S&P 500 index funds and funds benchmarked to the S&P 500. In fact, there is more $11.2 trillion in U.S. dollars alone indexed or benchmarked to the S&P 500, with indexed assets comprising approximately $4.6 trillion of this total. Demand for S&P 500 index funds creates demand for the stocks included in the index and can drive higher share prices.

There is also a significant concentration in the ownership of S&P 500 companies. 85% of the assets invested in S&P 500 index funds are managed by just five funds or ETFs: Vanguard 500 Index Admiral, Vanguard Institutional Index I, SPDR S&P 500 ETF, Fidelity Spartan 500 Index, and iShares Core S&P 500.

With much of the S&P 500’s performance contributed by just five companies, all in the same sector, and five funds holding the bulk of investments in the S&P 500, a market downturn can lead to a decline in the index, unrelated to the companies’ performance. The reason goes back to supply and demand. Many investors retreat to safety in a market decline, selling their positions and moving to cash or lower risk investments. With the growth of index investing and particularly investing in the S&P 500, that means a lot of selling pressure on the stock of the S&P 500 companies, particularly Microsoft, Apple, Amazon, Alphabet (Google), and Facebook, to meet liquidation requirements and keep the index funds aligned with the S&P 500. The same happens in reverse in a rising market as investors pile into S&P 500 index funds.

In just four years, the Information Technology sector has grown by 32% to represent 27.47% of the S&P 500 Index’s value, while the Energy, Financials, Industrials, Consumer Staples and Consumer Discretionary sectors have led declines in sector weight.

The information above is designed to help you better understand the S&P 500 Index and some factors that influence its value. It is not intended as investment advice. All investments have the potential for loss as well as gain.

Investors should consider the investment objectives, risks, charges and expenses of the investment company carefully before investing. The prospectus and, if available, the summary prospectus contain this and other important information about the investment company.

You can obtain a prospectus and summary prospectus from your financial representative. Read carefully before investing. Fund value will fluctuate with market conditions and it may not achieve its investment objective. All performance referenced is historical and is no guarantee of future results.

Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

TOP

Living in a World of Déjà Vu

It’s difficult to invest without believing in cycles. From business cycles and product cycles to stock market cycles, there is a tendency for patterns to repeat in variations on the theme over time.

In his most recent book, The Storm Before the Calm, geopolitical analyst George Friedman gives a new perspective to today’s political hostility, riots and turmoil. We are at the intersection of two major cycles in American history, he maintains. The first, an 80-year institutional cycle, results in a dramatic change in the way political and social institutions work and the relationship between state and federal governments. The second, a 50-year socioeconomic cycle, results from deep social and economic dislocation and dramatically changes social relationships and economic policy.

The 2020s are unique in the history of the U.S. in that both cycles turn over in the current decade. The good news is that these cycles are necessary and healthy, resulting in new technologies, opportunities for “disruptors” to excel, and ultimately a better country. The bad news is that the decade before the shift is characterized by political instability, electoral chaos, economic distress, and social discord for much of the population. And that’s all without the impact of Covid 19, which was just beginning to surface when the book was published.

Friedman’s message is disturbing in that he sees no quick resolution to the uncertainties and difficulties of life for many Americans. But it is also reassuring from the perspective that this is not new, it has happened before, it will pass, and the end result will be a better world -- until we outgrow the benefits of change and slip once more into the storm.

Institutional cycles, which shape the character and nature of government, have historically been driven by war, according to Friedman. Wars require rethinking and restructuring government. From December 7, 1941 to December 31, 1991, when the Soviet Union was officially dissolved, the U.S. was in a permanent state of war. Decision making in Washington was streamlined for crisis, not routine decisions. Efficient decision making beneath the crisis level has become rare. Two elements of the problem are diffusion and entanglement. Authority and knowledge are distributed among departments or agencies each with their own expertise but lacking a center. Multiple federal agencies are often engaged in managing parts of the same problem resulting in overlap and battles for turf and funds. The federal government no longer operates in a timely or efficient manner, forcing a new institutional shift, which will begin, based on the three preceding shifts, around 2025.

Based on Friedman’s timetable, the fifth socioeconomic cycle, in which we are currently, will end with the president elected in 2028, beginning a new 50-year cycle. During the transitional phase, we can expect political instability and chaos, followed by social and economic earthquakes.

What is oddly reassuring about Friedman’s scenario is the realization that we have been here before and past cycles have resulted in improvements in social, economic and government environments. They have also produced new disruptive technologies that transformed the lives and centuries old traditions of Americans and the world. “At the end and the beginning of each cycle, there is a sense of failure and disaster. Yet each time the United States has re-created itself, perhaps imperfectly, but with a rebirth of startling superiority,” maintains Friedman.

-----------------

This barely touches on the information in Friedman’s book, his sixth publication, including two New York Times bestsellers. It’s an intriguing read and worth your time, particularly if you are feeling discouraged by current events. Is Friedman’s view of history correct? We will only know in hindsight, but it is a reminder that with change comes opportunities for investors, opportunities that we want to be alert to and ready to exploit.

TOP

Discretionary versus Non-Discretionary Management

Given market volatility, it is important for individuals to understand whether or not their financial adviser has the ability to limit drawdowns in a portfolio or to take advantage of market opportunities by repositioning assets. This typically depends on whether the adviser has discretionary or non-discretionary management authority.

In Discretionary investment management, the accountholder authorizes a portfolio manager to make buy-and-sell decisions without referring to the accountholder. These decisions must, however, be made within agreed upon limits. The client’s investment policy statement governs the adviser’s ability to act defensively or opportunistically. For example, if the policy statement does not permit hedging, the portfolio manager cannot use hedging in an attempt to limit losses or achieve gains.

Under Non-Discretionary investment management services, the investment adviser can merely advise the client what may be good or bad for the portfolio. The client reserves full right to take his own decisions. While this gives the client the greatest control over his or her investments, it also places the responsibility for protecting a portfolio in market downturns squarely in the client’s hands. Unless the adviser is authorized by the client, a more defensive or aggressive investment position cannot be taken.

TOP

May the Power of the List Be with You

As much as we might like to have life go back to normalcy, back to the way we lived at the start of the year, coronavirus and the effects of lockdown may be with us well into 2021. If George Friedman, author of The Storm Before the Calm, is correct in his expectation of chaos and continuing political tensions as 50- and 80-year long term cycles in our government institutions, economy and social norms collide, life will be tumultuous for years.

When there are factors beyond our control impacting our lives it helps to remember the old prayer – “Grant me the strength to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference.”

One of the best ways to take control of your life is to start with a list. On the left side, list the things you can control; on the right, the things you cannot control. The left side is where your power lies. The right is where you have to accept that you have minimal, if any, influence over some elements of your life and that it will not do any good to invest your time in worrying about them. Instead, use the left side to make plans that can adapt to or moderate the uncontrollable.

One of the most important items on the left side is your time. You control how you spend your time. Start a new list with things you need to do or want to get done. Without a written list, it is much too easy to get distracted and fail to start or finish priorities. There is also considerable satisfaction to be found in completing and crossing items off a list. Post your list where you will notice it several times a day. Don’t let it disappear in a digital file that you can ignore.

Lists are also excellent tools for decision making. Looking at making an investment? List the pros and cons. Why will this be a good investment? What are the risks that could result in a loss? How will it fit with your existing investments?

Considering pursuing a new job or opportunity? Once again, write down the advantages and disadvantages of your current job; why you are dissatisfied; where your particular talents lie; what you enjoy doing the most and how your talents might fit a different job. Then look at the skills you might need if you change positions and how you can gain those skills if you do not have them now.

Lists are powerful tools for organizing our lives and orienting our talents. Next time you find yourself worrying about a situation, a problem or life in general, make a new list that forces you to look for pros and cons, good and bad, opportunities and drawbacks. Lists are a path to better answers. Put them to use!

TOP

Air and Water Are the Center of Better Health

The impact of coronavirus goes far beyond the potential of getting sick from Covid-19. Jokes abound about the Covid 15-pound lockdown weight gain. More serious, a tracking poll by the Kaiser Family Foundation found that 45% of adults said the pandemic had affected their mental health.

How do we re-center ourselves and get back on track to better health? Health consultant Yegene Chun recommends that you start with your breathing.

The first sign of stress is found in your breathing pattern. If you are taking shallow breaths or holding your breath, your body is in stress mode. The longer you stay at a heightened stress level with fight or flight reactions at full mode, the greater the damage you are doing to your physical health. “Bad stress isn’t when you reach the heart attack stage,” Ms. Chun explains. “It begins much earlier when you forget to slow down and breath properly.”

When you notice you are breathing shallowly, pause and focus on taking deep, even breaths. Keep your exhalations long and slow. As you slow your breathing, try to relax your muscles.

The second simple step toward reclaiming your health is to make certain you are taking in sufficient water. Our bodies are 60% water; our blood is 90% water, explains Ms. Chun. When we become dehydrated, inadequate water can have wide-reaching health impacts.

In addition to assisting with the supply of oxygen, water conveys water-soluble minerals and nutrients to different parts of the body, removes waste products from the body and regulates temperature. Water lubricates joints, improves skin health, and cushions the brain and spinal cord. It can also help prevent muscle fatigue and improve athletic performance.

Dehydration causes the blood to become thicker increasing blood pressure. A natural defense of the body to preserve water is to restrict airways, worsening allergies and asthma. Digestive problems can also result from inadequate water, including constipation and an overly acidic stomach, increasing the risk of heartburn and stomach ulcers.

Ms. Chen recommends not just drinking more water but increasing water from sources such as fruit and vegetables with important minerals and nutrients.

“You cannot rebuild your health if you are allowing stress to tear you down and undermine your efforts to be healthy or if you are not getting sufficient water. Those really are the two essential elements of feeling better, having more energy and enjoying your life,” she explained. “If you do nothing more than take these two steps, you will find yourself feeling better and gaining the ability to make life-long changes in your wellbeing.”

TOP