Staying Wealthy is a Matter of Planning

There are two sides to the wealth conundrum. The first is getting there. The second is staying there. A surprising number of people are good at getting wealthy, but not at staying wealthy. Lottery winners are one example. Fortune magazine quotes the Certified Financial Planner Board of Standards that nearly a third of lottery winners declare bankruptcy. They end up financially worse off than before they hit the jackpot.

So how do you stay wealthy?

- The first rule of preserving wealth is “Don’t invade your principal.”

Ideally you want to be able to live off the income stream produced by your investments and other sources, such as retirement account distributions or Social Security. It’s back to the don’t live beyond your means. The exception is if you are getting older, have no desire to leave an inheritance behind, and have a fairly good idea how long you will live and how much you may need to fund your remaining life. If you can’t take it with you, perhaps you should use your funds to enjoy life a little more.

- Diversify your sources of income.

Diversifying your sources of income gives you a hedge against a potential stock market crash, loss of rental income, loss of bond income, etc. If one source encounters problems, ideally by cutting back on your expenses you can continue to do well with your alternative sources.

- Think cheap. Have an eye for bargains.

Buy what you need, not what will make an impression and spend your money on things that last. If it’s cheaper to rent than own, rent. Memories of good experiences generally have a greater impact over time than purchasing an expensive item.

- Don’t be cheap when it comes to hiring quality service providers from attorneys to accountants, financial advisors and more.

Good service providers will save you money over the long run. Look for knowledgeable professionals who run a clean ship. Make certain they provide transparency, audited results, and accountability. And then, don’t trust them. Always verify.

- Invest in your health.

Eat right, exercise, avoid substance abuse. Even if you can afford the best doctors, reversing years of abusing your body may not be possible. As long as you are healthy, you are better able to care for yourself and less vulnerable to those who might try to exploit you for your wealth.

- Don’t forget to enjoy life.

Dying rich can be a waste of good assets. Know what you can afford to spend and then make certain your life is worth living.

TOP

Are You About to Be Scammed?

The problem with people is that we are basically nice. We want to think the best of others and we want to help those in need. Scammers and predators understand that as well. But they are not nice and they see others as sheep deserving to be fleeced.

There are two key red flags that can help you avoid being the victim:

- The scammer says they need money immediately.

- You are asked for personal details – in particular, credit card information, banking information and personal identification.

Unless you know the caller personally, always question the source of a phone call or email contact. Phone numbers and email addresses can be spoofed. Thanks to social media, it can be relatively easy for someone to find out personal information about you, family members and friends and use that information to convince you the message is real.

If you think you are being scammed…

- STALL. Tell the caller or email sender you need to find the information they want. Ask for contact information to follow up.

- VERIFY. Use your phone directory, contacts file, customer service numbers or any other source you know is accurate to verify the request. Call the IRS, the police department, Social Security, the non-profit or an individual that the caller says needs help,

- REPORT. If you have an obvious fraud, report it to the appropriate agencies listed below.

- WARN. Caution others about the fraud by letting family, friends and neighbors know about your experience.

Report Scams to the Following Agencies

Romance scams and tech support scams initiated via the internet and resulting in a phone call should be reported to the FBI’s Internet Crime Complaint Center (IC3) - https://www.ic3.gov/.

IRS scam calls should be reported to the Treasury Inspector General for Tax Administration (TIGTA) - https://www.treasury.gov/tigta/contact_report_scam.shtml

Lottery and sweepstakes scams, free vacation or prize scams, energy bill scams, tech support scams, loan and refinancing scams, fraudulent debt collectors, fake charities, medical alert scams, pharmaceutical scams, and telemarketers that do not respect the Do Not Call list should be reported to the Federal Trade Commission’s Complaint Assistant - https://www.ftccomplaintassistant.gov/

Telemarketers and debt collectors who are using caller ID spoofing should be reported to the Federal Communications Commission - https://consumercomplaints.fcc.gov/.

TOP

Managing Risk in Uncertain Markets Has Costs, But Creates Potential

The challenge of successful investing comes down to balancing risk and return. How much risk is there in the market? Do we strive to achieve the greatest return, or do we take a more conservative stance and chance underperforming in rising markets?

Active management is based on one of the realities of investing that is rarely emphasized in media coverage of the financial markets – markets tend to take a step backward for every two steps forward. When that back step happens can determine the long-term success of a portfolio. In the early stages, you have time to recover. The closer you are to retirement, the harder it is to regain your financial security. It comes down to the mathematics of gains and losses. If you lose 50% of the value of your portfolio to a down market, you need to earn 100% to recover from the loss. Preserve the value of your portfolio in declining markets, and instead of requiring gains to make up losses, you build portfolio value as the market recovers.

The argument against actively managing your portfolio and striving to take a more conservative positions during periods of high risk is commonly titled – Missing the Best. If by attempting to limit risk you miss the best days of the market, your performance will suffer. The flip side of the argument is typically overlooked – what if you miss the WORST days of the market?

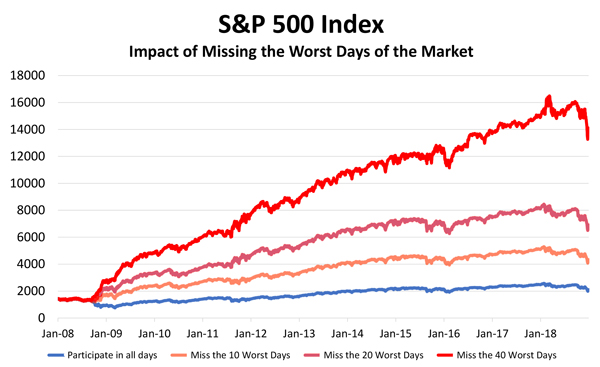

The graphic below illustrates what would happen to the value of your portfolio if you were to miss the worst 10, 20 and 40 days of the market from 2008 through 2018. The blue line represents a buy-and-hold position.

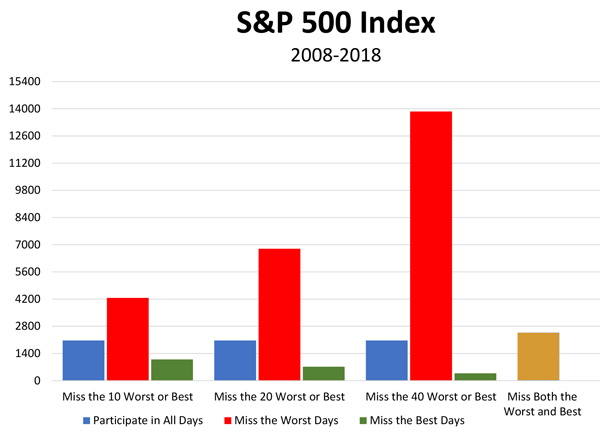

Looking at the difference in portfolio value on a bar scale shows the impact of missing down days in the market even more vividly.

The results shown in these graphics are hypothetical and statistically impossible to achieve. They are presented to show potential, not reality. Past performance is never indicative of future returns. A different time period would show different results.

Before you take these results to heart, you need to realize that they are statistically impossible. The odds of missing just the 10, 20 or 40 best and worst days over an 11-year period with more than 2770 trading days makes winning Powerball look easy. Adding to the difficulty is that history shows the best days tend to closely follow the worst days. Sometimes they occur back to back. If an investor misses one, chances are he will often miss the other as well.

What the data does show is that avoiding down days in the market has an outsized impact on returns. In the last column of the bar chart, the impact of missing BOTH the best and worst days outperforms a buy-and-hold position. This occurs regardless of whether you look at 10, 20 or 40 days. Why? Because recovering from losses means starting with less money to benefit from the days of good returns.

Naturally no investment strategy is perfect and not all trades will be profitable but preserving gains in down markets requires an active approach. The less value a portfolio loses, the better it is positioned to recover faster and take greater advantage of a bull market.

TOP

What is Your Real Risk Tolerance?

At the start of an investment advisory relationship, one of the questions we typically ask our clients is “How much risk are you willing to take?” Your answer may be in terms of percent of portfolio losses, dollar amounts, loss of initial capital or a score from a risk assessment questionnaire. That information, combined with more concrete data, such as years until you will need to withdraw your funds and how much money you have saved to date, is used to establish a risk weighted investment plan we believe will allow you to have the money you need, when you need it. Equally important, it has to result in a portfolio you are willing to hold through good markets and bad.

The problem is that risk “tolerance” is relative.

When you first answered the question, a number of factors influenced your response from current market conditions to your mood, prior investing experience, your sex, marital status, how you view your current level of financial security, job security and more.

With the exception typically of your sex, everything else is subject to change. In positive markets, people tend to be more willing to take on risk, assuming that losses can be quickly recovered. When markets turn down, risk tolerance changes. Behavioral finance has proven that losses have a greater emotional impact than gains and can distort risk tolerance by making an individual (1) less willing to incur additional losses or (2) willing to take on greater risk to make up for lost portfolio value.

Mood is particularly volatile and can be influenced by the media, personal events, and even your perception of whether or not the country is headed in the right direction. Divorce, illness, death of a love one, dissatisfaction with one’s work and other factors impact your willingness to take risks.

With that said, risk is a part of investing. While an active investment approach strives to manage risk and limit drawdowns, there will be times when your portfolio loses value or seems to plateau. While we can make no assurances as to the future performance of your portfolio, often these times are precisely when you don’t want to abandon the investment approach.

There is also the question of whether or not you need to take risk. Sometimes we get locked in to a mental risk tolerance level that is actually higher than it needs to be. If you have sufficient savings to fund your needs with low-risk assets, perhaps there is no need to have a higher risk tolerance level in your portfolio.

To make certain risk levels in your portfolio match your risk capacity, we ask that you call and talk with us. We need to know if there are changes in your life that necessitate changes in your portfolio, and if at any time you are not comfortable with your portfolio and how it is invested. And, we appreciate the opportunity to explain our investment strategy and its current performance. Our goal is a long-term relationship with you. Communication is a key part of that relationship.

TOP

Withdrawal Strategies and Your Estate

If you anticipate leaving assets to your heirs when you die, which assets will make the best inheritance? Should you spend down your retirement accounts or non-tax-deferred investments first? While the correct answer will depend on your unique financial situation, one consideration is the impact of taxes.

If you anticipate leaving assets to your heirs when you die, which assets will make the best inheritance? Should you spend down your retirement accounts or non-tax-deferred investments first? While the correct answer will depend on your unique financial situation, one consideration is the impact of taxes.

As of 2018, thanks to the Tax Cuts & Jobs Act, federal estate taxes won’t apply until an estate exceeds $11.2 million. For couples, $22.4 million can currently pass tax-free to heirs. The higher exemption is inflation adjusted, but like most of the individual provisions in the new law, it is scheduled to sunset by 2026. If a future Congress doesn’t change the rules again, in 2026 the tax-free amounts will revert back to 2017 levels.

Before you decide your estate will be too small to be affected by federal taxes, remember that your home state may have a different estate tax limits, and your heirs could end up with a sizeable tax bill at the state level. Plus, federal estate tax laws could change yet again. The withdrawal strategies you use today have the potential to impact your heirs in the future.

Investments and assets such as stocks and bonds, real estate, personal property and collectibles are “marked to market” when inherited. This allows their current market value to be used when calculating whether or not estate taxes apply. Because the accounts or assets pass to your heirs at their market value, no long- or short-term capital gains taxes are owed on accumulated gains during the period you held the assets. This can be particularly beneficial on assets with substantial appreciation. For example, stock you purchased for $125,000 that is valued in excess of $800,000 today would incur substantial capital gains taxes if sold before your death. Your heirs, however, would inherit the shares at a $800,000 basis. Capital gains taxes would be owed only on appreciation after your death.

There is no mark to market on retirement accounts. These accounts can be rolled over by your heirs into an inherited IRA or cashed out immediately or over a five-year period without incurring a 10% early withdrawal penalty if the heir is under age 59½. Regardless, when withdrawals are made from inherited retirement accounts, they are taxable at the heirs’ personal tax rate. In addition, retirement account balances are included in the calculation of the estate’s total value for the purpose of determining estate tax liability.

Life insurance and annuities add another layer of complexity depending upon how contracts are structured.

This article is not intended as tax advice but rather a highlight of some of the issues to consider when designing retirement income strategies. If you are concerned about minimizing taxes on your estate and optimizing the value your heirs receive, review your retirement income strategy with a qualified financial advisor or tax consultant. It could make a significant difference to your heirs.

TOP