Eclipses and Financial Markets

Watching the August 21st eclipse along the totality band brought home how traumatic the event must have been in earlier centuries. Daylight fading, temperatures dropping, and darkness coming over the land with no assurance that this too would pass would have been terrifying. Only by knowing this is a recurring cycle, created by the predictable movement of the earth, moon and sun, does an eclipse turn into a festival.

Bear markets need the perspective of knowledge as well if investors are to survive them and move on to the next phase of the market. Much like an eclipse, we need to understand that this is a recurring cycle in order to turn a down market into an opportunity for profit. While eclipses are far more predictable than human behavior and its impact on financial markets, we do know from experience that:

1. Bear markets are inevitable.

There is something in the human psyche that makes us prone to cycles of irrational exuberance followed by excessive negativism.

2. Bear markets do end.

By accepting the reality of bear markets, we can put in place strategies to detect increasing risk in the market and to limit losses when downturns begin.

And, because we also understand that bear markets end and the sun will return, we can plan for capturing the upturn early in the cycle.

Just as bear markets are inevitable, in a capitalistic system, where the opportunity to seek personal profit exists, new uptrends in the market are inevitable. Given an opportunity to innovate, to build, and to offer products and services that in turn make one wealthier, human nature takes over and the upward climb begins once again.

TOP

The Tyranny of Numbers

Really big numbers are hard to conceptualize. In August 2017, money market funds gained more than $70 billion, while domestic equity mutual funds and ETFs saw nearly $15 billion in outflows. International and investment grade bond funds gained assets. Reading the headlines, it sounded like investors were fleeing domestic equity funds in droves and headed overseas or to the safety of money markets.

Put the numbers in perspective and a different story emerges. Total assets invested in money market funds exceed $2.73 trillion. $70 billion is approximately 2.5% of total money market funds. In 2015, money market funds were significantly higher than today at $2.75 trillion, according to data from the Investment Company Institute.

Domestic equity funds – including index funds – hold more than $5.5 trillion in assets. $15 billion is less than 3/10s of 1% of total assets invested in U.S. equity mutual funds, and that is before considering hybrid funds that hold both equities and bonds.

$70 billion is a lot of money to anyone. But when you look at it in the context of total money market assets, it's a very small proportion. The problem is that given a choice between a headline that says "Cash is king for U.S. fund investors wary of stocks" and one that says "Investors increase money market assets by 2%," readers are more likely to opt for "Cash is king."

Without perspective, data is easily distorted to tell a story that is misleading at best and outright deceptive at its worst. Before you make a decision based on numbers and sensational headlines, make certain you look at the full picture.

TOP

It's Time to Start Thinking About Taxes

It's ironic that many investors will avoid financial management of their portfolios for fear of management fees in the range of 1-3% yet make no plans to manage taxes on their investments that can cost 20 to 50% of their gains. Taxes are easily one of the most corrosive elements in the financial world. The best time to reduce the impact of taxes on your income is long before you start compiling information for filing your taxes. By the fourth quarter of the year, the countdown is on for putting effective strategies in place.

Managing the tax bite starts with understanding what triggers tax liability.

The structure of your account

If your funds are invested in a tax-deferred account – such as an Individual Retirement Account, 401(k), 403(b), SEP-IRA, etc., you are typically able to defer taxes on earnings you contribute to the account and all gains from profitable sale of assets, interest, and dividends until monies are withdrawn from the account at retirement. You don't have to worry about tracking income or profits. Everything will be taxed at your personal income level when withdrawn (unless you withdraw funds before retirement, in which case you will incur additional penalties).

If your funds are invested in a taxable account, such as a regular brokerage account or mutual fund account, you will incur taxes every year on (1) any interest, ordinary dividends, and short-term capital gains you receive, taxed at your top personal income tax rate and (2) qualified dividends and long-term gains from the sale of securities in the account (less losses), taxed at fixed levels – 0%, 15% and 20% at the federal level - based on your income tax bracket. High-income taxpayers are assessed an additional 3.8% tax on certain investment income, as part of the Affordable Care Act.

Profits from the sale of securities are considered short-term gains for assets held for less than one year or long-term gains for assets held for more than one year before sale.

What if your investments have gone down in value? It doesn't matter as far as the taxman is concerned. All that matters is whether or not you had gains from actual interest and/or dividends paid, or from the sale of assets in the account.

The mutual fund tax impact

Internal transactions within mutual funds will impact you from a tax standpoint. While most funds managers are relatively adept at limiting short-term gains, gains from the sale of positions within the fund and dividends must be distributed to shareholders on, at minimum, an annual basis and must be reported on your taxes, even if you do not sell shares or withdraw the gains. At the end of the year, the mutual fund will issue Form 1099-DIV, detailing long and short-term gains and distributions for your use in compiling your tax return.

All dividends, short and long-term gains, on which you are taxed, increase your tax basis in your mutual fund. When you liquidate positions in a taxable mutual fund, taxes are calculated based on the price of the shares when sold less your original purchase price and ALL previously taxed gains – this reduces the tax impact when you sell fund shares and assures that you are taxed on gains only once.

Basic guidelines to help reduce taxes:

Defer taxes by maximizing your use of tax-advantaged accounts, such as retirement accounts.

Withdrawals will be taxed at the investor's personal income tax rate, but will be able to grow and compound tax-deferred.

If you have both taxable and tax deferred accounts, match the right account with the right investment.

Investments or investment approaches that incur a primarily short-term gains, dividends, and distributions are best placed in a tax-deferred account.

Use a taxable account for individual investments most likely to be held in excess of a year generating primarily long-term gains. This will typically result in the lowest tax impact for these investments. The investor also has the flexibility to plan capturing losses to offset gains.

When investing in index funds, use Exchange Traded Funds (ETFs) rather than mutual funds.

Mutual fund managers must constantly re-balance the fund by selling securities to accommodate shareholder redemptions or to re-allocate assets. This potentially creates capital gains for all shareholders, even for shareholders who may have an unrealized loss on the overall mutual fund investment. An ETF manager accommodates investment inflows and outflows by creating or redeeming "creation units," which are baskets of assets that approximate the entirety of the ETF investment exposure. As a result, the investor usually is not exposed to capital gains to accommodate redemptions or rebalancing. Exceptions are inverse and leveraged funds - which have proven relatively tax inefficient, international funds and commodity ETFs.

Take full advantage of deductions.

Above-the-line deductions don't require itemizing and include expenses such as alimony payments, self-employment taxes, IRA contributions, school supplies, student-loan interest paid, and more. To make the most out of itemized deductions, such as medical and dental expenses, charitable contributions, work-related costs, theft, disaster and casualty losses, and other deductible items, "bundle" those expenses, concentrating deductions in every other year, so that you're able to itemize in one year and take the standard deduction in the next.

In the end, the government will get its share, but there's no reason not to strive to limit the tax bite as much as possible. After all, the less the government takes, the more you have to invest and to ultimately spend on your needs.

If you have questions on taxes and your investments, give us a call and let's review your situation and how your tax bite can be minimized to your long-term advantage.

TOP

As if we didn't have enough to worry about as we age, from medical costs to fears of outliving our money and more, it turns out there is yet another threat ahead – grumpiness.

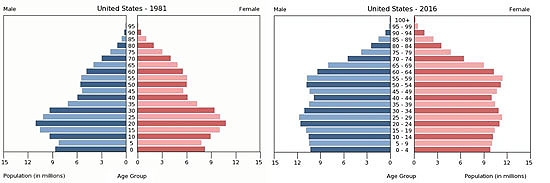

If you have noticed a lot more grumpy people about and particularly grumpy older men you are not alone. One reason is that there are a lot more older men and women around. Men over 65 now number in excess of 21 million in the U.S., while women have topped 27 million. The grumpy bulge shows up in the ballooning of the over-60 crowd in the 35 years from 1981 to 2016.

Grumpiness has become so widespread that it is actually the subject of considerable research as well as numerous books ranging from "How Not To Murder Your Grumpy" to "You Can Heal Your Life."

The good news is that there is typically a reason for increased grumpiness, and it may well be fixable.

(1) Those Darn Hormones

Women and teenagers aren't the only ones suffering hormonal swings. It turns out that men also experience hormonal changes as they age with testosterone levels dropping as they approach 60 and into their older years. Lower testosterone levels can cause mood swings, depression and plain old grumpiness. Because testosterone levels decrease gradually, grumpiness may also increase gradually, muffling its onset. In addition to age, a number of factors can lower testosterone including stress, a poor diet with too many bad fats, autoimmune diseases, some drugs, and abdominal fat, which produces estrogen, neutralizing testosterone and causing levels to drop further.

(2) Health issues.

Grumpiness and increased irritability also tend increase if you are dealing with wearisome health problems, chronic pain, fatigue, or sleep problems.

(3) Emotional issues

Emotional issues dramatically impact our outlook on life and inclination to experience irritability or just plain grumpiness. Stress or loss of partner; changes in living situations; fear of losing control, looking foolish, being in trouble, or maybe even getting hurt, can all contribute to frustration or a sense of powerlessness. Realizing one is no longer young and running out of time, and may never achieve dreams and ambitions can increase negativity. As can fear of running out of money.

(4) Retirement

Retiring can be a cause of grumpiness in successful individuals who feel they have no aspirations or goals left to achieve. Without work, one can lack a sense of purpose or self worth. Getting older also makes us more aware of our own mortality as friends and loved ones die. We worry about the future.

Curing the grumpies starts with making certain there is not a hormonal or health reason. Once those issues are considered, you need to start looking at what in particular makes you grumpy. Rather than indulging in more of that irritant, it helps to avoid problem sources. Sometimes, simply turning off the news can work wonders. Getting away from grumpiness may require an activity you enjoy that involves you with other people. Volunteering can restore a sense of purpose and make one appreciate the good fortune in one's life.

There are also times when a little therapy will not go amiss. Grumpiness may be a way of avoiding an issue you don't want to deal with, or of keeping people at arms' length. If you genuinely enjoy being a curmudgeon, grumpiness may be a tool to perfect your persona. But grumpiness can also be a form of depression that takes joy out of life. Given we may be around a lot longer than earlier generations, it doesn't make sense to let grumpiness take the fun out of life and push people away from us.

TOP

Hey, Millennials, Are You Eating Too Many Avocados?

Australian millionaire and real estate mogul Tim Gurner predicts that millennials will never be able to afford many of the benefits their parents enjoy from home ownership to financial security. The reason? They eat too many avocados, among other expensive habits.

"We're at a point now where the expectations of younger people are very, very high," Gruner said in an interview in Money magazine. "They want to eat out every day, they want to travel to Europe every year. The people that own homes today worked very, very hard for it, saved every dollar, did everything they could to get up the property investment ladder."

In place of avocados, the traditional financial advice to millennials is to:

- BE THRIFTY

- Shop the sales

- Be patient when spending

- SAVE NOW

- Start an emergency fund -- $20, 50, 500 per month for unexpected expenses

- Max out your 401k at work or make a monthly contribution to an IRA

- Invest your bonus or salary increase

MANAGE YOUR CREDIT

- Check your credit score every 6 months

- Pay off high items interest first

- SET FINANCIAL GOALS

- Want to own your own car or house, take a trip or start your own business? -- Set a realistic date for the goal

- Have a plan to pay off student debt

- EDUCATE YOURSELF

- Read one book this month on a finance related topic of interest to you

Successful millennials, according to Inc. Magazine, have some interesting additions to the list:

- DON'T EVER DO ANYTHING JUST FOR MONEY

- Ben Lee, co-founder and CEO of Neon Roots

- DO SOMETHING YOU ENJOY

- Robbie Dickson, founder of Firgelli Automations and Attivo Designs and co-founder of the Canadian Bullrun Rally

- DELIVER EXCEPTIONAL RESULTS QUICKLY

- Jason Raznick CEO of Benzinga.

- DETERMINE WHETHER SOMETHING IS ACTUALLY IMPORTANT

- Lingke Wang, co-founder of Ovid

- CRITICIZE YOURSELF

- Zain Dhanani, founder and CEO of Atlanta-based investment and advisory firm Tinsli

- BE PASSIONATE ABOUT EVERYTHING YOU DO

- Shazir Mucklai, angel investor and adviser in disruptive startups

- BUILD, SCALE, SELL, REPEAT

- Eddie Madan, CEO of Toronto-based Edkent Media

- CONFIDENCE LEADS TO SUCCESS

- Carlo Cisco, founder of Select.

- DON'T LET AGE DETERMINE YOUR SUCCESS

- Trevor Gormley, SentryStone Capital managing partner

Achieving financial goals requires first setting goals and then developing a plan to reach them. And along the way, it's up to the individual to decide if avocados fit the plan and budget. Take some time to think about where you want to be in another 5, 10 or even 15 years. And then strategize your plan, ideally with a financial advisor who can help you think through the path to reach your goals.

TOP