An Updated Look at an Old Fallacy

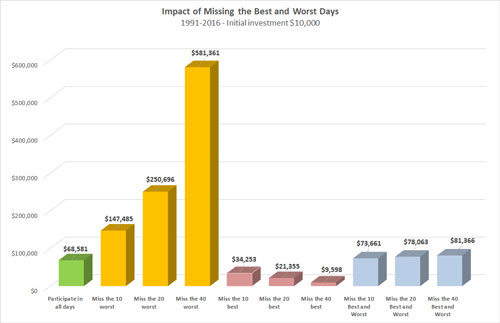

One of the most common arguments against trying to actively position assets to take advantage of market trend is "Missing the Best." In this approach, the supporter of passive management points out that no one is able to perfectly forecast the market and if you miss just the best 10, 20 or 40 days of the market your returns decrease dramatically.

Which makes it interesting to take an updated look at the data behind the argument. In the 25 years of S&P 500 daily returns ending 2016, missing the best does indeed dramatically affect performance. But there's more to the story. What if you miss the worst days? And therein is all the rationale and reason for active management. Losing money hurts performance far more than missing the best up days. But, what is also interesting is that missing both the best and worst days of the S&P 500 over the past 25 years actually produces better performance than a buy-and-hold investment.

How easy would it have been to miss the worst days? If you were out of the market during 2008, you would have missed 17 out of 40 of the worst days of the last 25 years. The worst day for the market was October 15, 2008 when the S&P 500 fell -9.0%. Miss the first four months of 2009 when the market was still struggling and you would have missed 23 of the worst 40 days or 58% of the worst days for the market in 25 years. For trend followers, these would have most likely been the times one would naturally be out of the market. And as the graphic above shows, missing the worst has a dramatic impact on performance.

But, if you were out of the market 2008 through the end of April 2009, you would also have missed 20 of the best 40 days for the S&P 500, with the best day on October 13, 2008 topping 11.5%. Which brings us to the reality of financial markets. The best and worst days often occur in close proximity when market volatility spikes. The odds that one would miss just the best or just the worst days out of 6,552 trading days are next to impossible. But it is much more likely that one could miss both the very best and very worst and outperform a buy-and-hold investment in the process.

Another interesting fact from the study: If you look at the average for the 40 best and worst days, the average good day was +5.2%, the average worst day was -5.0%. Out of the 6,552 days in the study, 3,059 had negative returns, while 3,489 were positive and four days had no change in value from the prior day. What conclusions might one draw from that information? The one that jumps to mind is that buy-and-hold investing is a very inefficient way to make money, with the S&P 500 up just 11% more days than it was down. Active management is an attempt to make the financial market more efficient by participating in up moves and avoiding the down trends.

Behind the potential for active management to outperform the market is the mathematics of gains and losses. If your investment is down 20%, it doesn't take a 20% increase to return to breakeven, it takes 25% because you are starting from a smaller portfolio value. As long as the active manager avoids the majority of the down trend, there's room to miss part of the uptrend and still outperform a buy-and hold-investment, typically with a lot less volatility, or risk.

Naturally, there can be no guarantee that an active investment management strategy will achieve its objectives.

TOP

The Pluses and Perils of a Longer Life

For many people, retiring in one's 50s or early 60s sounds like a dream come true. Imagine years of health and time to achieve one's goals, whether traveling the world, spending more time with family and friends, developing the perfect golf game or looking for volunteer opportunities where one can make a difference. There's just one catch. Will your money last 40 to 50 years?

Before you start planning your finances around a projected average life span of 84 (men) or 86 (women) years, remember that you could be among the 50% that live much longer. About one out of every four 65-yearolds today will live past age 90, and one out of 10 will live past age 95.

And therein lies the peril of retirement planning. We could be around a lot longer than we expect. Ironically, the more money we have, the more we will probably need because the more affluent are most likely to live the longest. Access to more expensive healthcare may be part of the reason, but the more money people have over their lifetimes, the more likely they have taken better care of their health, eaten better diets, exercised more, etc.

So yes, a long life can mean more time to enjoy the activities and people we love. Combined with good health it can mean a more adventurous, busier life than generations before have experienced. But living costs money.

When you sit down to make your retirement plans, think about building flexibility into your life.

- How much money will you need to live comfortably to 90 or 95?

- Should you be saving more than you are now?

- Does it make sense to work a little longer and save a little more before you retire?

- How can you reduce your living expenses, but still enjoy the life you want? A smaller home? Fewer toys? Less expensive hobbies?

- What are the opportunities for you to continue earning money in retirement? (Keep in mind that the more you make, the less you get to keep of any Social Security payments.)

- Would it be smart to start developing a healthier lifestyle? Keeping healthy in retirement not only allows you to be more active, but also reduces medical costs.

- Given your current health and heredity, would you expect to need long-term care later in life?

- What exactly do you want from retirement? Sometimes what we really need isn't retirement but employment that we enjoy.

Retirement planning is one of those activities that is best done with others (particularly if you are married!). Sitting down with your financial advisor and your spouse or significant other and exploring not just the money, but what you want to do with your life can help you gain a more objective outlook on the future. It can also make certain everyone is on the same game plan and looking at ways to make it a reality. Even if you are already retired, revisiting your plan, seeing how well it is working and where problems could crop up never hurts.

Give us a call today and let's take some time to review where you are, where you would like to be, the possible perils ahead and how to avoid them.

TOP

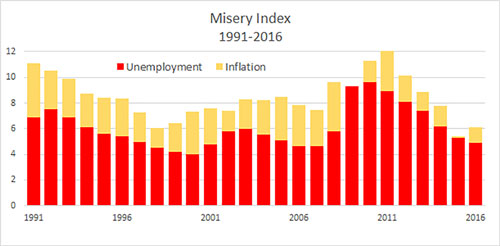

The headline was quite clear – THE MISERY INDEX IS ON THE RISE. The rest of the copy explained that increases in the misery index are followed by market downturns and that investors need to move now to position their assets safely. But was the message accurate?

Yes, there is a Misery Index. It's simply unemployment plus inflation. Is the index on the rise? Yes, but the rise is minor and the relationship is questionable as the graph below shows.

Thanks to the Internet, we have an incredible opportunity today to check the reality of facts that media, marketers and con artists throw at us each day. Before you panic, despair or bite on a dangling worm, take a moment to check the facts.

Political facts are the hardest to check in part because there are a growing number of online fact-checkers that are actually partisan platforms. Rather than relying on these sites, look for the source of the data. Some sites to consider when checking whether a "fact" is truth, fiction or exaggeration, consider some of the following sites and don't hesitate to search the internet for sources of data. Just keep in mind the old saying about history being written by the winners.

- Snopes.com is one of the oldest and relatively bias-free fact-checking sites.

- TruthorFiction.com is an email reality checker. This is a good site to verify whether the latest pass-around email is actually true.

- HoaxSlayer.com aims to counteract criminal activity by publishing information about common types of Internet scams. They also include anti-spam tips, computer and email security information, articles about true email forwards, and much more.

- Data.gov is managed and hosted by the U.S. General Services Administration, Technology Transformation Service and offers access to a wide range of government based data.

- USA.gov/statistics provides U.S. Census Bureau information and other information

- bls.gov is the Bureau of Labor Statistics - the principal fact-finding agency for the Federal Government in the broad field of labor economics and statistics.

Twitter feeds are not always reliable or that informative, but a number of the U.S. government agencies maintain twitter feeds to announce the release of information. If there is a department you are particularly interested in, conduct an internet search for their twitter handles. @FBI, @FBIPressOffice, @FBIRecordsVault are some of the Twitter feeds of the Federal Bureau of Investigation, for example.

And always keep in mind a line popularized by Mark Twain, from British Prime Minister Benjamin Disraeli: "There are three kinds of lies: lies, damned lies, and statistics."

TOP

The Number One Source of Identity Theft is Your Wallet

When it comes to identity fraud, the biggest source of information isn't online, but in your wallet, warns crime prevention officers. Purse snatchings, pickpocketing, theft of purses from locked vehicles and robbery are the biggest sources of identity theft. These thefts don't require much know-how, and because they rarely involve weapons, typically have lower penalties if the individual is caught.

While the victim may not be able to prevent the theft – and the officers urge individuals NOT to fight back or resist – they can avoid handing the thief all of their information.

While the victim may not be able to prevent the theft – and the officers urge individuals NOT to fight back or resist – they can avoid handing the thief all of their information.

A simple purse snatching can provide a thief with cash, credits cards, checks, bank account numbers, car keys and registration information on the car (making it easy to identify and steal), address and access to the victim's home, and more.

From Cary Johnson of the 1st Judicial District Office in Colorado come the following tips:

- Go through your wallet or purse and reduce the amount of financial information you carry with you. If you don't need to have personal information with you, leave it home in a secure place.

- Carry only what you will need for the day. Take one credit card, one debit card or check, not a whole book of checks. Never have debit card pin numbers with your card.

- Carry your identification and credit card in a card-size wallet that you can hang around your neck under your clothes, put in an inner coat pocket, a deep pants pocket, or, if need be, "the bra."

- If you need vehicle registration or insurance cards with you, carry ones without your home address. Have as little information as possible on you with home information.

- Lock your phone. Many phone companies have "self-destruct" or lockdown routines that prevent access to programs and data after a certain number of false login attempts.

- Do take a purse or carry bag with you for personal belongings you might need, just don't have your identification and credit card in it. This is an easy decoy if someone wants to rob you.

- Never leave identification and credit cards in your car when exercising. Thieves are often watching parking areas at rec centers, gyms and popular running spots for potential car thefts.

If your information is stolen, act quickly to prevent its use. The thieves know they will have limited time to use the information and will be moving quickly.

- Stop payments from bank accounts immediately - particularly if you had a debit card in your purse with pin numbers. Most banks have 24-hour numbers.

- Notify credit card companies.

- MASTERCARD: 1-800-627-8372 (US) or 1-636-722-7111 (Global)

- VISA: 1-800-VISA-911 (1-800-8472-911) or 1-303-967-1096 (Global, call collect)

- AMEX: 1-800-528-4800

- DISCOVER: 1-800-347-2683

- Have the big three credit bureaus place fraud alerts on your accounts.

- Experian: 1-888-EXPERIAN (1-888-397-3742)

- Equifax: 1-800-525-6285

- Trans Union: 1-800-680-7289

- File a report with the police.

- They may not be able to do anything, but this provides evidence in your favor should you become a victim of identity theft or fraud.

- If your keys were stolen, arrange to have locks changed on your vehicle and home.

- Notify the driver's license bureau if your license has been stolen or contact other sources of identification - including student IDs, to alert them to the theft.

- If your Social Security card was in your wallet

- Call the IRS Identity Protection Unit at 1-800-908-4490

- File the loss with the Federal Trade Commission at 1-877-ID-THEFT

- Report the loss to the Internet Crime Complaint Center

- Try to list everything else that was in the wallet

- Other items in your wallet may seem insignificant but could come back to haunt you. These include memberships to movie rental stores, work ID cards and access badges, medical insurance cards, computer passwords, and padlock keys.

- Order Credit Reports

- Every year, you are entitled to a free credit report from each of the three major credit bureaus, without any strings attached. The easiest way to obtain these is to visit the Annual Credit Report site. Then, take a close look at them to spot any possible fraudulent spending.

TOP

From the Movie "The Big Short"…

What does it take to outperform the financial markets?

- Find inefficiencies in the market, value that is being overlooked, or overestimated.

- Do your homework and make certain there isn't something you don't know that creates the appearance of inefficiency.

- Have sufficient knowledge in your decision that you can reality check your investment and stay with your call if it doesn't perform on schedule or as expected but still makes sense.

Mix in a little healthy skepticism with regards to the wisdom of the financial behemoths and you could end up on the right side of the trade. All of which adds up to a good reason to rent, stream or buy the movie "The Big Short," released in December of 2015. The movie chronicles a small group of investors who collectively made billions off of the housing collapse in 2008. To explain complex financial transactions, the viewer encounters a model in a bubble bath, a chef, an alligator in the swimming pool and other incongruent explanations that work amazingly well.

There's no sex, no car chases, no emotional entanglements, no violence, but it is absolutely fascinating if you are interested in the financial markets or in the least bit curious as to what all went wrong to cause the housing collapse and the bear market of 2008.

TOP