The U.S. Stock Market is in New Territory

While the U.S. stock market was hitting new highs in 2017, a fundamental change was underway. The number of publicly traded companies was continuing to contract. In 1996, there were 7,322 domestic public company listings. Today there are 3,671. There are no longer 5,000 stocks to make up the Russell 5000. Instead it includes roughly 3,500 according to Jason M. Thomas of the Wall Street Journal*. There were more initial public offerings in 1996 than there have been over the past five years. The delisting rate over the period has also been high, in part driven by acquisitions and mergers over the last 10 years as companies have found it cheaper to acquire businesses than to build existing market share.

That's not to say that there are fewer businesses today than in 1996. In fact, the number of businesses has increased from nearly 4.7 million in 1996 to 5.9 million in 2015. But fewer are choosing to list on the stock exchanges. The decline in public ownership of U.S. businesses is attributed to a number of causes from excessive government regulation and disclosure requirements, to the difficulties of dealing with activist investors, less need to raise large amounts of capital to fund business development in a digital world, increased private funding sources, and outsourcing to overseas contractors.

The decline in the publicly traded company is very much a U.S. trend. The number of public companies increased by almost 30% elsewhere in the world since 1996, including nearly 50% increases in other developed countries and a 12% in emerging economies.

A number of concerns are raised by the decline in U.S. listings:

- Publicly traded companies are larger than ever,

- Large companies often find it difficult to grow revenues and profits faster than the economy,

- Opportunities to invest in early stage growth companies are increasingly limited to private equity investors,

- Initial public offerings come to market much later in the company's growth cycle after private equity investors have benefited from early exponential growth,

- IPO subscriptions are concentrated among large institutional players,

- Retail investors are shut out of many profitable investment opportunities.

Equity investments have long been the primary means of growing retirement assets and enabling individuals to share in the growth and profitability of successful companies. While the impact of fewer public companies will eventually be known only through hindsight, if the concerns above are valid, it says investors and investment advisors need to work harder and smarter to profit from market gains. Past performance is not an indication of future gains and passive investing based on historical performance is more at risk than ever. Investment approaches must be able to respond to a changing market environment with new risks and challenges.

As we enter 2018, that is very much the goal and direction of our firm.

* Where Have All the Public Companies Gone? By Jason M. Thomas, The Wall Street Journal, Nov. 16, 2017

TOP

Welcome to the Prediction Games

Wondering where the stock market is going in 2018? There's no shortage of individuals willing to voice their opinions, and many would like to charge you for them as well. A quick Google search offers 2 million answers. Many may be right. But based on prediction data collected from market forecasters since 1998 by CXO Advisory Group, market experts accurately predicted market direction 48% of the time. A coin toss would have been just as accurate.

"Those who have knowledge don't predict. Those who predict don't have knowledge," maintained poet and philosopher Lao Tzu in 6th Century BC – 2500 years ago.

Adding to the hazard of believing in market predictions is our own cognitive bias. We are attracted to forecasts that match our current beliefs or gut feel.

Successful investing is based not on predictions but on preparation. We admit that we don't know where the market will be next month or six months from now, much less for all of 2018. What we do have is a plan to protect assets when market risk exceeds our parameters and to return to the market when a recovery appears to be underway. We let the market tell us what we need to do. "Above all, remember this: Markets can remain irrational a lot longer than you and I can remain solvent."

Investing on the basis of predictions is no more than a coin's toss.

TOP

Floods, Fires, and the Need to Prepare for Disaster

As 2017 made all too clear, natural disasters come in many different forms from wildfires to hurricanes, earthquakes, floods, severe weather conditions and more. Even when they don't impact us directly, side effects, such as the loss of electricity for hours or days can profoundly impact our lives.

While there is little we can do to prevent natural disasters, we can be prepared to weather their effects intact.

First - have adequate property insurance.

According to Nationwide Insurance, about two out of every three homes in America are underinsured. The underinsurance amount averages around 22%, though some homes are underinsured by 60% or more. Most replacement value insurance policies will only pay up to 120% of your coverage limit, no matter how much it costs to rebuild your home. In a widespread disaster, the costs of rebuilding are often driven even higher due to the extra expense of scarce materials, contractors, and clearing an unsalvageable building.

Your insurance needs to be adequate to replace both damaged buildings AND their contents. Homeowner's insurance policies have specific limits as to the value of contents covered under the general policy. Know what those limits are and make certain values in excess of that amount are covered by insurance riders.

Flood losses are not covered under homeowners' insurance policies. Federally backed flood insurance is available through the National Flood Insurance Program, managed by the Federal Emergency Management Agency. However, your community must have agreed to adopt and enforce floodplain management ordinances to reduce future flood damage to qualify for the insurance.

If you must evacuate…

Ideally, you should keep hard-to-replace documents such as birth certificates, wills, deeds, automobile titles, stock certificates, Treasury notes, bonds, loan documents, insurance policies, and other vital papers in a safe deposit box away from your home. However, there is always the possibility that the safe deposit box location could be destroyed. Copies of all documents in the safe deposit box as well as passports, account numbers and contact information, an inventory of home possessions along with photographs of the property, and other vital documents that would be difficult or impossible to replace should be in a readily accessible file in your home or available online. Members of your family should know where to find the hard copy file or online records and be prepared to retrieve the documents should evacuation be required, or your home threatened.

BUT, before you upload this level of personal information to cloud storage, you need to encrypt the data. Without encryption, you are at risk that your personal data could be stolen in transit or from the storage server. Encryption software has become too inexpensive and easy to use to not take advantage of the technology. Don't trust the online storage provider to provide security for your information.

Have a liquid emergency fund.

Problems are always easier to cope with if you have money. Remember if you need to relocate, you will need funds for rental deposits, to replace lost property and clothing and to pick up the pieces of your life. While your homeowner's insurance may cover those costs, you typically will not receive any settlement until after an adjuster visits the property. In a widespread disaster, that could take weeks.

When you leave your home,

Turn off the electricity, water, and natural gas. This will reduce the danger of fires and of contaminated water getting into your home's plumbing. Always shut off all the individual electrical circuits before shutting off the main circuit breaker.

Discard perishables from your refrigerator and freezer. If you are unable to return home before perishables begin to rot, you may have to discard the appliances. It's cheaper and less odorous to discard food in advance.

If you have animals on your property that you are not able to take with you, make certain they have some form of identification with a means to contact you such as cell phone number.

If you are unable to evacuate…

You should be prepared to survive on your own for a period of three days to a week after a widespread disaster. When disasters affect a large area, there are always more victims than rescue personnel. It could be impossible for someone to quickly come to your aid. Basic services such as electricity, gas, water, sewage treatment, and telephones may be cut off.

You will need drinkable water, food, warmth and first aid supplies. You will also want flashlights, a battery-operated radio, fully charged batteries in cell phones, laptops and other portable equipment, extra batteries, and a full tank of gas in your vehicles.

Water is your first priority. If you have advance knowledge of a potential disaster, fill up water containers, bathtubs and sinks in advance. If there is a possibility of broken water or sewage lines, you need to protect the water sources in your home from contamination by turning off the main water valves. If necessary, you can later drain the pipes and your water heater for drinking water. You should also have a means of purifying water by boiling, chlorinating, filtering, or distilling suspect water.

Commercially canned food can be eaten without warming, however, you should have an alternative cooking source such as candle warmers, chafing dishes, fondue pots, or a fireplace. Cooking grills and camping stoves should be used outside only.

Have a good quality first aid kit and first aid book on hand as well as common medications such as aspirin, decongestants, antibiotic creams, cough drops, etc. If you need prescription medications, you should have ample supplies of those drugs.

Surviving a disaster is often a matter of attitude. If you have thought out possible scenarios and prepared for them in advance, it's much easier to emerge with your life intact. While worrying about potential problems doesn't always guarantee that they won't happen, it really does make the problem a little smaller if it comes about.

TOP

Medicare Primer for Individuals Nearing Retirement

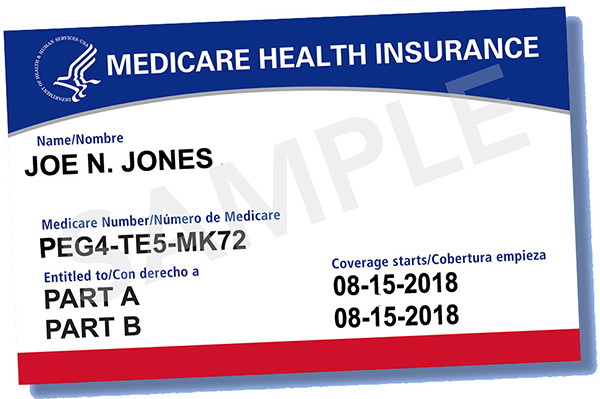

One of the big unknowns when it comes to planning for retirement is the cost of medical care. One resource Americans can count on – at least at this point – is Medicare. But it helps to understand what Medicare is and isn't and its limitations.

Medicare is a government health insurance program that covers much of the cost of hospital stays and doctors' office visits for individuals over age 65, those with long-term disabilities, end stage renal disease and other specified health issues, as well as low-income beneficiaries. Since President Lyndon B. Johnson made Medicare law by signing H.R. 6675 in 1965, every paycheck you have received has included a deduction for Medicare – currently 1.45% from employees with a 0.9% surtax on earnings over $200,000, matched by an employer contribution of 1.45%.

Medicare does not pay for all of your health care costs. There are co-pays, deductibles, and premiums unless you qualify for a low-income program or have other additional insurance. Coverage also has limitations. The information below is a primer on Medicare. It is not intended as legal advice or as a comprehensive overview of an increasingly complex benefit. But hopefully, it will help you better understand one element of your medical coverage in retirement.

1. Enrolling in Medicare

If you are already receiving Social Security benefits, when you turn 65 you will be automatically enrolled in Medicare Part A and Part B. Part A is free. You definitely want to be enrolled in Part A. You can choose to turn down Part B, since it has a monthly cost; if you keep it, the cost will be deducted from your Social Security payments.

If you are not receiving Social Security, you must apply for Medicare during seven-month Initial Enrollment Period, which usually begins three months before the month you turn 65, includes the month you turn 65, and ends three months after the month you turn 65. Coverage starts the month you turn age 65. If you fail to sign up during this initial registration period, you could be charged higher premiums the rest of your life. The exception is if you delay registering for Medicare due to group insurance through your current job. You must sign up for Medicare within eight months of leaving your job, however, to avoid the higher premium costs the rest of your life.

2. Medicare Options

Medicare Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Medicare Part A is free if either you or your spouse paid Medicare payroll taxes for at least ten years. (People who aren't eligible for free Part A can pay a monthly premium of several hundred dollars.) There is currently a $1,316 deductible if you are hospitalized. Additional costs will apply if you are hospitalized for more than 60 days.

Medicare Part B covers doctors' visits and outpatient services. In 2017, the standard premium for this initiating this coverage was $134 per month. Premium costs are higher for individuals with a modified adjusted gross income of $85,000 or higher or couples with income in excess of $170,000. In 2017, the Part B deductible was $183 after which you would be responsible for 20% of the Medicare approved cost of services. Many preventive care services, such as flu shots, mammograms, cardiovascular screening every five years, screenings for cervical, prostate, and colorectal cancers, and an annual wellness visit, do not have any cost sharing, however, you could incur costs for tests and lab services.

Medicare Advantage and Medicare Part C are alternatives to traditional Medicare coverage offered by private health insurance companies, such as Medicare HMOs and PPOs, which provide coverage for Part A, Part B and (usually) Part D services in a single benefit package, typically with different premiums and restrictions. Costs and deductibles depend upon the level of coverage.

Medicare Part D covers prescription drug costs. There are a range of plans and coverages with premiums varying based on the coverage level you select. The average Part D premium in 2017 was $34 a month. In addition to premium costs, there are co-payments, deductibles and other out-of-pocket costs. Part D coverage typically includes a "donut" hole, a coverage gap when you must pay out of pocket for all prescriptions. In 2017, the coverage gap began when a beneficiary's total drug costs reached $3,700. While in the hole, you receive a 60% or 49% discount - depending on whether brand-name or generic drugs are used – until total out-of-pocket costs reach $4,950. At that point, catastrophic coverage begins with the government picking up most of the costs.

Part D premiums and prescriptions covered change every year, so it can pay to shop around during the open enrollment period each year from October 15 to December 7.

A Medigap plan will pay for some of traditional Medicare's out-of-pocket costs and deductibles – but you must purchase a Medigap policy in the six months after you turn 65 and enroll in Medicare Part B. You can switch Medigap plans at any time, but you could be charged more or denied coverage based on your health if you choose or change plans more than six months after you first sign up for Part B.

3. Care exceptions

Medicare typically doesn't cover routine hearing, vision, foot or dental care; medical services outside of the United States, or more than 100 days of long-term care such as nursing homes or assisted living. Generally, Medicare does not cover costs for "custodial care" to help with activities of daily living, such as dressing and bathing.

Health care services not covered by Medicare include, but are not limited to alternative medicine - including experimental procedures and treatments, acupuncture, and chiropractic services (except when manipulation of the spine is medically necessary to fix a subluxation of the spine); cosmetic surgery (unless it is needed to improve the function of a malformed part of the body), and most non-emergency transportation. While there may be exceptions in specific circumstances, there are no guarantees. Even for Medicare-covered services, Medicare very rarely pays 100% of the cost. There will be deductibles and coinsurances.

Medicare may also opt not to cover:

- Services and supplies that are not medically reasonable and necessary

- Services and supplies denied as bundled or included in the basic allowance of another service

- Items and services reimbursable by other organizations or furnished without charge

If you anticipate retiring in the next two to three years, start checking out Medicare Advantage, Part C and Part D coverage now to better understand how those costs will impact you in retirement. Evaluate policies with your current state of health in mind as well as hereditary health patterns in your family. If you anticipate substantial long-term care requirements the early you purchase such coverage, the better. The older you are, the less likely you are to qualify for long-term care insurance.

TOP